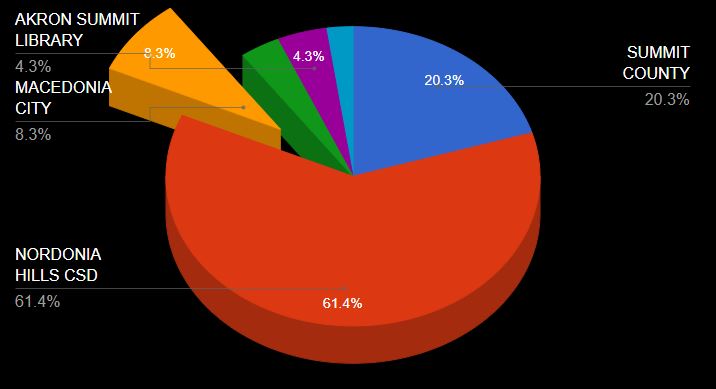

I am a fiscal conservative. I do the best I can to pay attention to where my tax dollars are spent. My wife and I moved to Macedonia partly because it has one of the lowest tax rates in Summit county.

I prefer that my tax dollars go to something local that has a direct impact on my family. When the governor wanted to balance the budget, many Ohioans supported the concept. In theory, it makes sense to balance the budget. In doing so, it put more responsibility on the residents of each community in our state. This has placed a burden on our city by reducing funds we receive from state income tax by $3 million in the last 5 years. If we want to maintain what we have, any reasonable person would see the need to replace a large portion of that loss.

We passed an income tax increase in 2017, but that was specifically earmarked for desperately needed road repairs. Also, the fire levy will expire at the end of the year. This will put money back into our pockets. If Issue 20 fails, we will see noticeable reduction in safety services. Macedonia property taxes have been the same since 1976. Income tax is the same since 1997.

Our tax system is unfortunately set up so that a vast majority of income tax comes from people who actually don’t live in the city they work in. Many residents won’t even see an increase in their income tax if they work in a city where the tax rate is already 2.5%. Seniors and others who are not earning a wage won’t see their taxes increase. Even if your income tax does goes up, it’s 0.25% – a small price to pay for a very sound investment.

Jason Roberts