A few years ago I published a web-based tax calculator to help the community determine the impact of new, expiring, or renewal property and income tax proposals that were on the ballot.

Earlier this year a number of people familiar with the calculator asked me to bring it back for what became Issue 5. The Nordonia Schools Bond issue is a 7.75-mill bond issue that would raise $165 million over 37 years. Proponents of levies and bonds always speak in round number hypotheticals, such as saying the annual cost would be $271.26 for each $100,000 dollars of valuation.

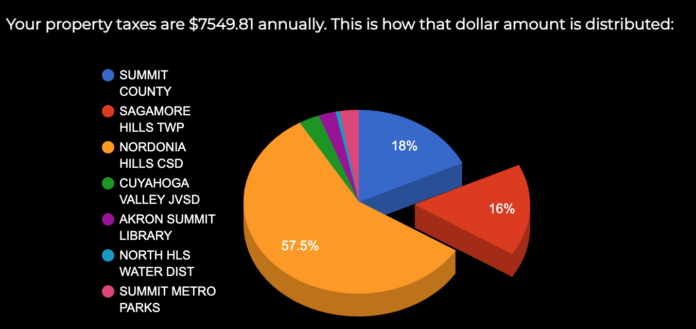

Most people have no idea how the valuation of their property is calculated and oftentimes will under or overestimate what the levy will cost them. One of the reasons I originally wrote the tax calculator was to address the question levies and bonds always leave me with: What would this tax increase actually cost me? As has been the case in other levies my calculator helped compute, the proponents of Issue 5 point out that two bonds will expire over the course of the next five years, reducing the overall tax burden a resident will pay when taken into consideration with the increases Issue 5 would bring. The calculator visually illustrates exactly what you’re paying for those bonds today, and what their impact will be (both before and after they expire) on your tax bill both if Issue 5 passes or fails.

By the time this letter is published the calculator will have served up over 1,000 results to users looking to learn more about Issue 5. The initial anonymous metadata is interesting to me so I thought I’d share it. Of those people who have used the calculator the average home market value (as determined by the Summit County Fiscal Office) is $245,214, but their taxable value averages $85.825. This taxable value (35% of the market value) is what the county will use to determine what any property tax increase would do to your bottom line. The increase users of the calculator are seeing ranges anywhere from $270/year to $1700/year, while the average falls somewhere around $657.27 per year, or what amounts to an increase of 22% for property owners.