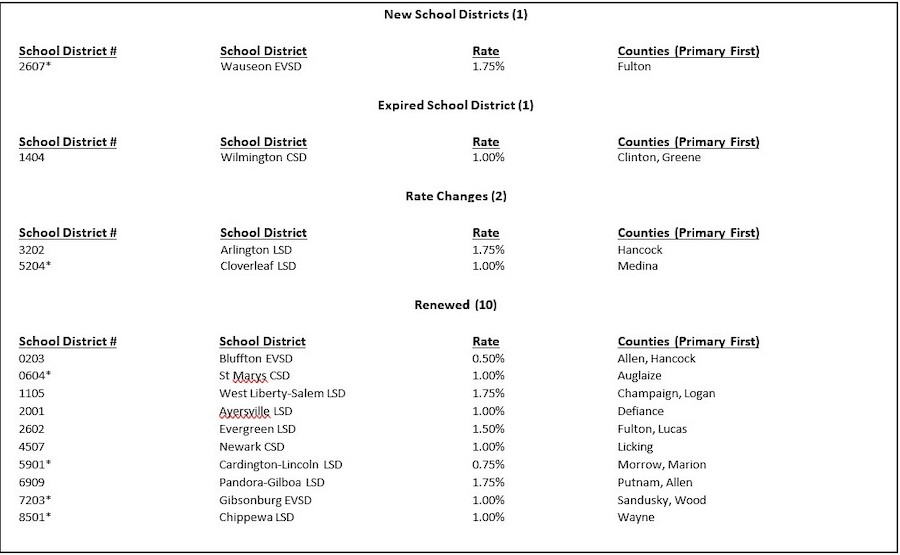

The chart below lists the updates to school districts effective in 2023. The changes include a newly enacted school district, an expired school district, school districts that changed their rate percentage, and those districts that renewed their school district rate at the same existing percentage. In addition, the tax rate percentage and whether the district adopted a traditional tax base or earned income tax base is also listed for each district.

For a complete list of all school district tax rates effective for January 1, 2023, click on the following link: 2023 School District Rates. For more information on employer withholding and school district withholding, click on the following link: Employer Withholding.

Updated School Districts Effective January 1, 2023

*Districts with an alternative earned income only tax.

Note: When you create W-2s for your employees, you should identify the school district by its four-digit code. By doing so, you will help your employees avoid any delay in the processing of their income tax returns.